Wine Investment: An Expert Guide

- What are the advantages and disadvantages of wine investment?

- How does wine investment differ from equity investment?

- How would a savvy investor manage his / her wine investment?

- What make a good investment choice?

Wine Investment: Advantages and Disadvantages

Wine investment offers attractive returns. Depending on the year range selected, wine investment in general has outperformed many equities index.

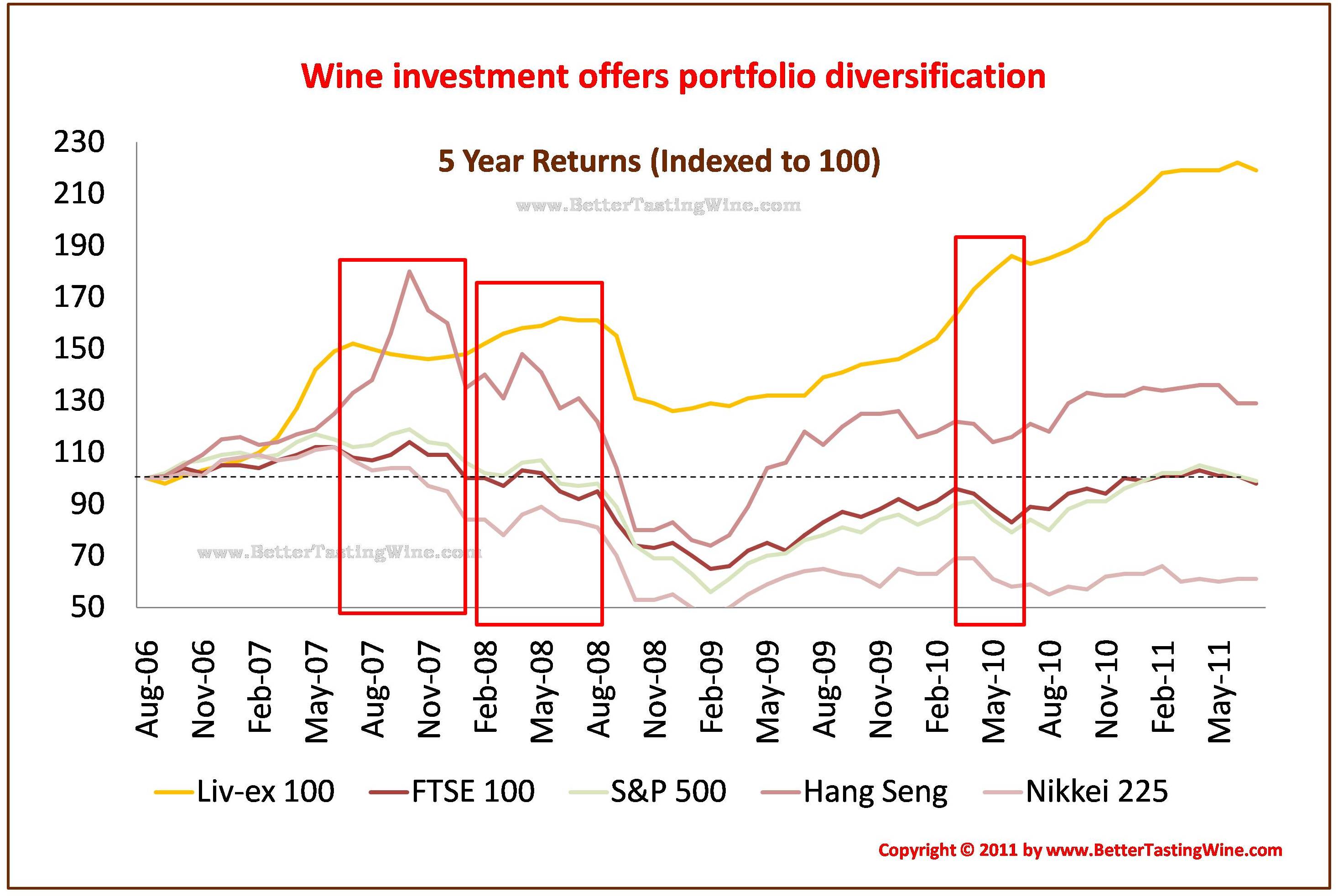

As the graph below illustrates, in addition to return, wine investment offers portfolio diversification. In some years where equities dived (Feb - May 2008), wine investment offered a counter-balance and vice versa (Aug-Nov 2007).

In addition, wine investment is in general less volatile than equities. It is also a consumable asset so no capital gain tax imposed.

The disadvantages, on the other hand, is the lack of liquidity. Unlike the stock market with established real time exchange and common stock codes, there is no live trading platform where titles and sales of wine transfer is real time. There is no common trading code for a case of Lafite, unlike say Nasdaq AAPL for Apple Inc.

High cost of storage and high commission selling fee are other consideration factors. There are also supplier and product risks. There are plenty of fake wines in the market; and the wines could be heat damaged during storage or broken during transit.

Last but not least, it is a relatively unregulated market compared to the equity and bond markets. Not all wines will appreciate with time so expertise is required.

How does Wine Investment Differ from Equity Investment?

The biggest similiarities with all investment is that the biggest underlying driver is the supply and demand curve. When there is more demand than supply, the price will go up. When there is more supply than market demand, the price will go down.

Buying Wine En Primeur is similar to buying IPO. En Primeur is the first chance to buy a wine, when it is still maturating in barrel, usually 1-2 years prior to release time. Historically, buying en primeur was the lowest price; however in recent years, that is no longer true thus dampening the attractiveness of buying wine en primeur.

There are, however, many differences, some we have mentioned earlier: The liquidity adn trading platform are different. There is no Dow Jones or Nasdaq exchange for wine. There is no dividends on wine and there is storage cost.

Shares can be diluted with new issuance. Wine supply, however, will only go down with consumption. Once a vintage is harvest, no more wines from the same year can be produced.

Last but not least, wine is a tangible asset. It is drinkable and there is no capital gain tax.

How would a Savvy Investor Manage his/her Wine Asset?

The most important is ensuring the source of wine is good. Once a bad wine is purchased, there is not much you can do to reverse that. Be cautious of buying fake wines or out-of-condition wines. Check for leakage, label condition, neck condition, and maturity before investing.

Also it is important to work with credible merchants, especially when buying en primeur. Avoid scandalous companies and ensure your wines are stored at professional wine cellars. Always buy in original wooden case or cartons, as providence matters at the point of sales.

Last but not least, investment returns come with sales. Track the value and maturity of your investment and always sell before the wine peaks. Remember different wines have different maturity timeline [for more details, refer to our wine collection lesson].

What Makes a Good Wine Investment Choice?

The must-have is a recognizable and prestigious brand, without which there is no guarantee of market demand. Vintage matters. If you are preparing for long-term investment, say over 10 years, you will need a good to excellent vintage that can age over 10 years.

Remember supply vs. demand. If it is a mass wine that has a large annual production [e.g. Cloudy Bay despite the prestigious marketing brand], it is unlikely to offer an attractive return. And think of global demand, not just local ones. China, for example, has contributed to the massive jump in the price of Lafite!

Rating does make a difference... If buying before a good rating, most investors will enjoy a good return. However when buying after a big media buzz (and the price has already jumped because of its high rating), chances are future expected returns on the investment will be quite slim.

Below are some exmaple of good wine investment brands:

Final Words...

There are wines for enjoyment and wines for investment. They are not necessarily the same thing.

Remember to do your homework when coming to any type of investments. Work only with trust-worthy merchants and do check out the condition, the current market price and expected maturity of the wine before buying.

Stay informed. Follow us and subscribe here to get our latest wine insider news and tips:

Practical Wine Lessons: Wine Tasting Like a Pro | Grapes | Serving Wine | Food Pairing | Preservation | Temperature | Restaurant Ordering | Wine Labels | Wine Regions | Wine Storage | Start a Collection | Common Wine Myths.

Useful Wine Tips: Ten Facts to Become an Instant Wine Pro | Vintage Guide | Removing a Broken Cork | Serving Order of Wines | Fastest Way to Chill a Wine | Host Wine Party | Elements of a Good Wine | Wine Investment "Winning" Guide | Leftover Wine: Recipe for Vino Punch | Freeze Your Leftover Wine | Wine Moods Pairing | Best Way to Preserve Champagne After Open | Ten Must-Have Wine Accessories.

Tasting Tutorial: Cabernet vs. Merlot vs. Pinot Noir | Sauvignon Blanc vs. Chardonnay vs. Riesling | Burgundy vs US vs New Zealand Pinot Noir.

Fun Download: Wine Tasting Scorecard | Wine Serving Temperature Chart | Wine Aroma Table | 3 Must-Know Red Grapes | 3 Must-Know White Grapes | Vintage Chart | Wine Party Themes | Wine Region Maps | Grand Cru Chart | Wine and Moods Pairing Chart | Wine Quotes & Wine Humor.

Travel & Exploration: Champagne 101 | Bandol | Italy | Spain | Sherry.

Jewels & Gems: Grower Champagne Pierre Gimonnet | Gravner Ribolla - An Amber Wine Maturated in Clay | Gaja - King of Barbaresco.